Cryptocurrency staking represents a fundamental shift in how individuals can earn rewards from their digital asset holdings. Unlike traditional methods that often involve active trading or investment in volatile markets, staking offers a relatively stable means of earning additional cryptocurrency. At its core, staking involves holding funds in a cryptocurrency wallet to support the operations of a blockchain network.

This introductory guide will delve into two primary forms of staking: traditional cryptocurrency staking and its more recent counterpart, liquid staking. Each has its unique features and implications for investors, which we will explore in detail. As a case in point, we’ll reference Pond Coin, an intriguing project that exemplifies these staking methods. Whether you’re a seasoned crypto enthusiast or new to the digital currency world, this comparison will shed light on these innovative investment strategies, paving the way for informed decisions in the evolving landscape of cryptocurrency.

Understanding Traditional Cryptocurrency Staking

Traditional Cryptocurrency Staking: A Primer

At its most basic, traditional cryptocurrency staking is akin to earning interest in a savings account but in the digital currency realm. Users lock up their coins in a wallet to support the network’s operations, including transaction validation and network security. This process is central to Proof of Stake (PoS) blockchains, where the probability of a user validating transactions and earning rewards is proportional to the number of coins staked.

How does traditional crypto staking works

Imagine you own some digital currency, like Ether. By staking your Ether in a compatible wallet, you’re essentially depositing it to help maintain the network’s integrity. Your staked Ether becomes part of the process that validates transactions and adds new blocks to the blockchain. In return for this service, you earn rewards, typically in the form of additional Ether, proportionate to your staked amount.

Benefits and Drawbacks of traditional crypto staking

The allure of traditional staking lies in its simplicity and potential for steady returns. It’s generally less risky than trading cryptocurrencies and provides a passive income stream, making it attractive for long-term investors.

However, traditional staking isn’t without its drawbacks. Your staked coins are locked for a period, during which you cannot trade them. This lock-up period varies between different cryptocurrencies and can impact liquidity. Additionally, the returns depend on the network’s overall staking volume and coin value, introducing some level of risk.

Example Project: TitanX

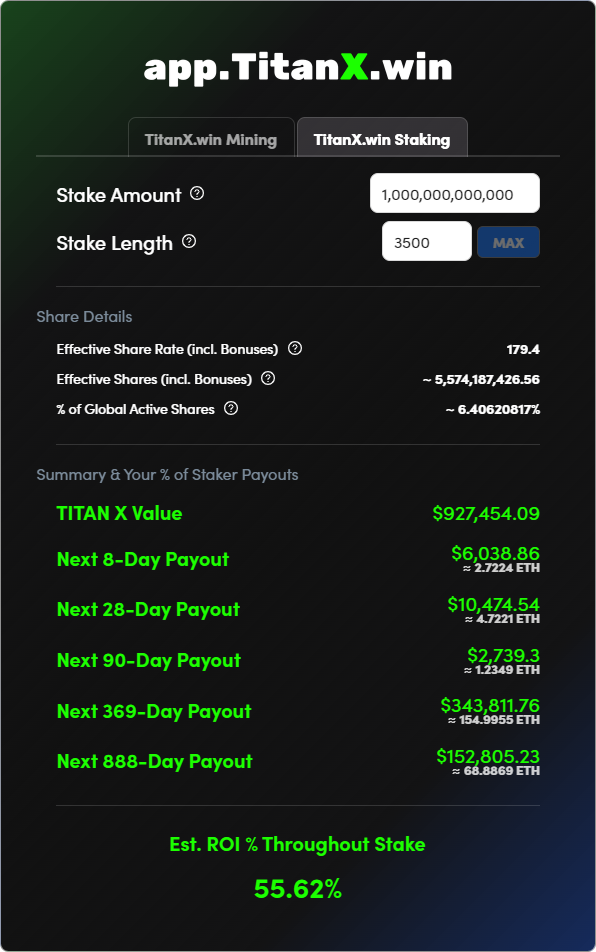

Staking on TitanX.win works as follows:

1. ETH Payouts to TITANX Stakers: When you stake your TITANX, you are rewarded with Ethereum (ETH) during each “payout cycle” based on your percentage of the total share pool. The share rate, which determines the number of shares you receive when you stake your TITANX, increases daily.

2. Stake Length and Bonuses: The minimum stake length is 28 days, and the maximum is 3,500 days. There are share bonuses for longer stakes, with a maximum bonus of +350% on day 2,888. After this point, the bonus remains capped at +350%, but you can stake up to 3,500 days.

3. Rolling Payout Cycles: These cycles occur at intervals of 8 days, 28 days, 90 days, 369 days, and 888 days. ETH is distributed during these cycles, with varying percentages added to each cycle length. These cycles will continue indefinitely as long as there is participation in the protocol.

4. Shares: Your stake in TITANX is converted into shares, and the number of shares you hold compared to the total determines your portion of the ETH payouts during your staking period.

5. Penalties: If you end your stake after it has reached 50% maturity but before the set end date, you lose 50% of the TITAN in stake, which is burned. If the stake is not ended within a week after the end date, you lose 1% of TITAN per day until 99% is lost after 100 days.

6. Distribution of ETH: Of the ETH used for mining TITANX, 62% goes to a Buy & Burn smart contract, 28% is distributed to TITANX stakers, 7% to the Burn Pool for TITANX burners, and 3% to the Genesis pool.

This system provides a way for TITANX holders to earn ETH passively by staking their tokens, with rewards determined by the amount staked and the length of the stake. The process is designed to incentivize long-term holding and participation in the ecosystem.

Exploring Liquid Staking

Liquid Staking: An Evolution in Cryptocurrency

Liquid staking is an innovative twist on traditional staking methods, addressing some of its inherent limitations. In liquid staking, participants receive a token representing their staked assets, which can be traded or used in other DeFi (Decentralized Finance) applications. This approach maintains the staking benefits while adding liquidity, a significant advancement for stakers.

How It Works

When you engage in liquid staking, your staked cryptocurrency is still used to support network operations. However, in return, you receive a representative token, often called a staking derivative. For instance, if you stake Ether in a liquid staking protocol, you might receive a token like stETH (staked ETH) in return. This token mirrors the value of your staked Ether but remains liquid, meaning you can trade it or use it in other DeFi protocols while still earning staking rewards.

Advantages and Potential Risks

The main advantage of liquid staking is the liquidity it provides. Stakers are no longer required to choose between earning rewards and having liquid assets. This flexibility is a significant draw for many investors, especially in the fast-moving DeFi space.

However, liquid staking comes with its own risks. The most notable is the potential mismatch between the value of the staking derivative and the underlying asset, especially in volatile market conditions. Additionally, engaging with DeFi protocols introduces layers of complexity and potential smart contract vulnerabilities.

Example Project: Pond Coin (PNDC)

Liquid staking on PondX.com works by aggregating liquidity across decentralized exchanges, bridges, and chains into the Pond DX interface. This system pools fees from swaps and distributes them as rewards to active participants. The rewards are calculated based on the frequency, volume, and types of tokens that are swapped within the network. Essentially, PondX creates a mechanism where users can earn rewards from their participation in the decentralized exchange ecosystem, enhancing the value and utility of their staked assets.

Comparative Analysis

Key Differences and Similarities

While both traditional and liquid staking are grounded in the principle of supporting blockchain networks and earning rewards, their mechanisms and implications for investors vary significantly.

- 1. Liquidity: The most striking difference lies in liquidity. Traditional staking locks your assets, making them inaccessible for trading or other uses until the end of the staking period. Liquid staking, however, offers a flexible alternative by providing a tradeable token, maintaining your access to liquidity.

- 2. Risk Profile: Traditional staking is generally considered less risky due to its straightforward nature. In contrast, liquid staking, while offering greater flexibility, introduces additional risks associated with token valuation and smart contract vulnerabilities.

- 3. Usability in DeFi: Liquid staking shines in the DeFi ecosystem, as the derivative tokens can be used in various DeFi applications, broadening investment and earning opportunities. Traditional staking does not provide this level of integration with the DeFi space.

- 4. Staking Rewards: Both methods offer rewards for staking, but the reward structure might differ. Liquid staking may have variable rewards based on the performance of the derivative token and the underlying asset.

Suitability for Different Investors

Traditional staking suits investors seeking a straightforward, lower-risk way to earn passive income. Liquid staking, with its added flexibility and integration with DeFi, appeals to those willing to navigate higher risks for potentially greater rewards and liquidity.

Pros and Cons

Traditional Cryptocurrency Staking

Pros:

- Simplicity and ease of understanding.

- Generally lower risk compared to active trading.

- Steady passive income through staking rewards.

- Enhances network security and efficiency.

Cons:

- Locked assets: Limited liquidity during staking period.

- Dependence on the network’s performance and coin value.

- Limited utility in the broader DeFi ecosystem.

Liquid Staking

Pros:

- Maintains liquidity: Tradeable staking derivatives.

- Integration with DeFi applications, offering broader financial opportunities.

- Potential for higher rewards due to DeFi integrations.

Cons:

- Higher risk due to market volatility and smart contract vulnerabilities.

- Valuation complexities between staking derivatives and underlying assets.

- More complex, requiring a better understanding of DeFi protocols.

Conclusion

In summary, while traditional staking offers simplicity and lower risk, liquid staking introduces flexibility and integration with DeFi, albeit at higher risk. Understanding the nuances of each can empower investors to make choices aligned with their risk tolerance and investment goals in the dynamic world of cryptocurrency.